deloitte work from home allowance

Welcome kit is provided to campus placements only. Generally it takes the form of 23 days of work from home and remaining from office based on engagement manager approval.

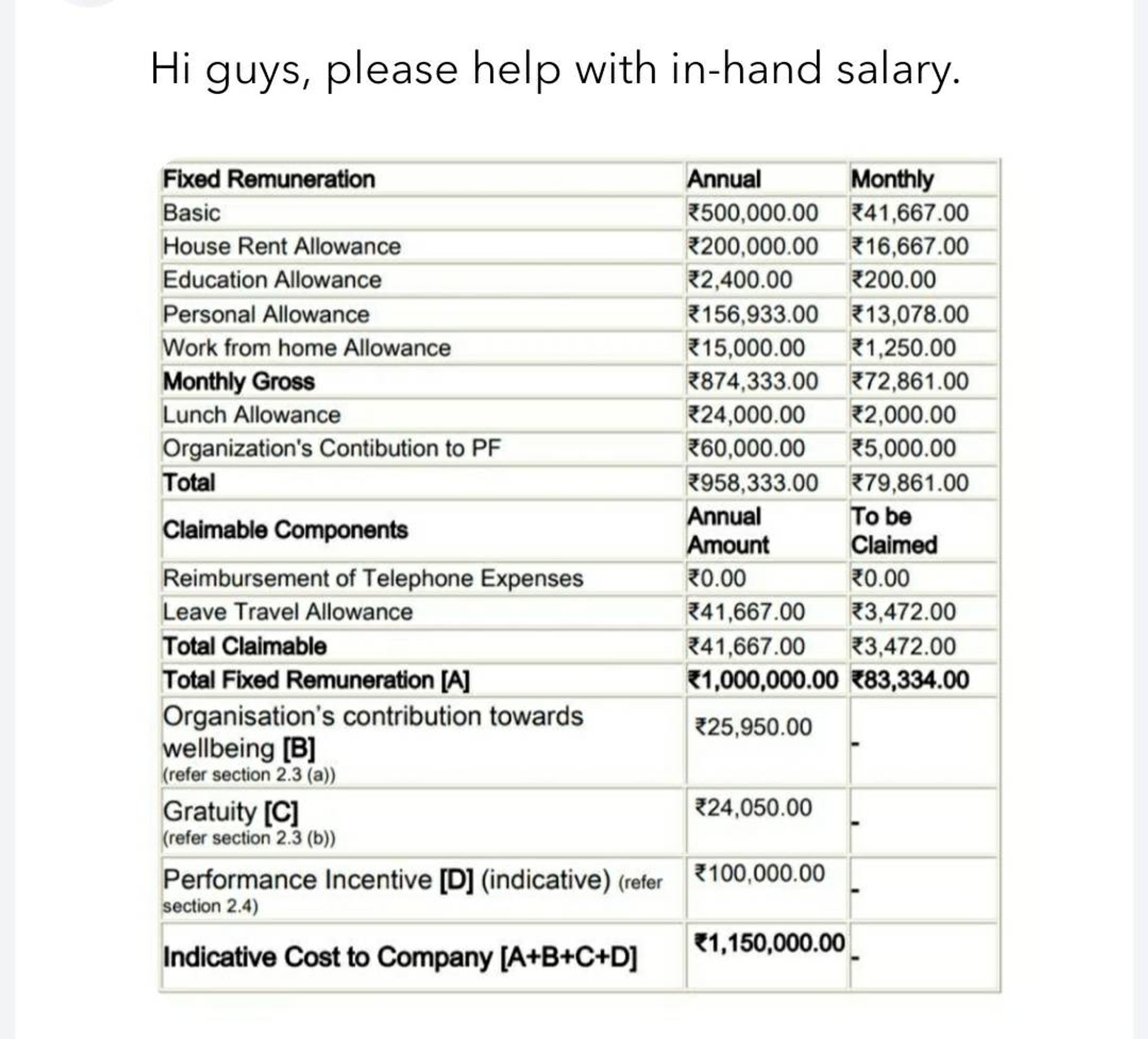

What Would Be The Take Home Salary For The Below Breakup In Deloitte India 1 Will The Pf Deduction Be Only Once 14500 Or Will It Happen Twice I Read Somewhere That

You are currently posting as works at.

. You are currently posting as works at. Deloitte Lead DS Senior Consultant. In order for employees to deduct employment expenses from their income including home office expenses employees must be required to work from home and to bear the expenses.

160k TC Internal Remote Minimum travel Small consulting firm Principal DS Partner. Deloitte 300 subsidy for necessary work from home equipment though some offices are reporting an allowance of 500. It has forced employers across the.

Learn about flexibility and work from home benefits at Deloitte. It has been asked that is direct benefit cannot be provided then a provision for tax-related relaxations should be made. As far as we know none of the big firms are providing any meal reimbursements for staff working from home as a rule.

Explore parental leave policies and other benefits company culture and general support. Lateral hires get Laptop charger headphones and a laptop bag based on stock availability. Demand for work from home allowance.

Deloittes Total Rewards and Benefits program offers a comprehensive variety of programs and resources to support the life journey of our professionals. Work from home setup allowance is provided. Work from home setup allowance is provided.

I received two offers and would love to get some input. Incurred in respect of the home office. Hey all - joined a last week and used the WFH allowance to buy a couple things.

Across the entire organization unless there was some sort of negotiation you receive 4 hours of sick time a month. Hybrid Productivity Allowance - Imp guideline. Information about company support and remote work due to COVID-19.

Used some of it to buy an office chair because I heard it was allowed. For more information refer to the guidelines document DisclaimersReturn of Property. That makes no sense for the WFH hybrid subsidy.

Household expenses that may be included in your home office tax deduction include your bond interest or if you are renting a house the rent payable by you rates and taxes electricity insurance domestic workers wages cost of repairs etc. Employees to work from home. We care about our people and we want them to be successful in their professional and personal lives.

Those working from home may want to claim a deduction on their personal income tax return for home office expenses incurred. Tax services and financial services company Deloitte India has sought the benefit of work from home allowance for salaried employees recently as per a Zee News Hindi report. If yes how much.

You can only WFH if you have Covid and are well enough to work or if you are home with someone that has Covid. We do not allow work from home arrangements whatsoever even though some managers including my boss can occasionally. Can anyone please check and confirm.

Yes it exists but it depends of which Deloitte practice and project one is in. We initiated a work-from-home technology subsidy of 500 and a temporary expansion of reimbursable commuting expenses to enhance hybrid work further enable the transition to new ways of working and to help our professionals feel safe connecting with each other in person. Income Tax Advantage Upon HRA for WFH.

HRA has arrived through the portion of the salary and can be claimed through the employees residing on rent. Any other joining benefits. Although Im sure everyone around here would love to say firms are just cheaping out on meals this year and blaming the.

After looking through the allowable tech on DNet I dont see an office chair on there. Explore work from home during COVID-19 remote work support and work-life balance. Lateral hires get Laptop charger headphones and a.

The term remote work allowance can also be used to refer to tax deductions that remote employees can claim but well cover this in more detail later. Work from home setup allowance is provided. Does Deloitte provide work from home allowance to new joiners.

After joining you will get an email with details like how much can be reimbursed and procedure to do that. Once one completes confirmation based on manager confidence one may avail this facility. After joining you will get an email with details like how much can be reimbursed and procedure to do that.

30 days ago ParentsWork Deloitte ranked 7 on the Fatherly and Scary Mommy two of the most popular digital media brands for todays parents have recognized Deloitte with three awards in 2021. A remote work allowance or remote work stipend is a monetary sum paid to employees. At Deloitte our people are our greatest asset.

But in the Financial year 2020-21 there are multiple salaried persons specifically young ones who. Welcome kit is provided to campus placements only. Rs 50000 Work From Home Allowance For Private Govt Employees ExpectedCOVID-19 has badly hit salaried employees since the start of the pandemic.

In addition to household expenses other amounts that. Deloitte ranked 7 on the Fortune Best Big Companies to Work For list in 2021. We are Deloitte includes many elements for example.

Guidelines mentions that items purchased under this allowance is to be returned once an employee leaves the firm. Best Places to Work for Moms Dads and Parents Working. Explore support and satisfaction with programs for new and emerging graduates.

Towards the salaried individuals the tax exemption upon the house rent allowance HRA is an essential advantage. In view of the pandemic offices. Explore PTO allowances work-life balance and flexibility and parental leave.

Welcome kit is provided to campus placements only. It also reflects our continued commitment. 240k-280k TC bon more.

Its designed to help workers cover their expenses while working remotely. One may receive additional days from home if one is attending late night early. Lateral hires get Laptop charger headphones and a laptop bag based on stock availability.

After joining you will get an email with details like how much can be reimbursed and procedure to do that. Deloitte recommends that an additional deduction of work from home allowance of Rs 50000 be given to employees in India too who are working from home.

Work From Home Allowance September 2020 Tax Alert

Does Deloitte Provide Work From Home Allowance To New Joiners If Yes How Much Any Other Joining Benefits Fishbowl

Is There A Wfh Allowance In Ey Gds Life 15k In Deloitte Usi Fishbowl

Work From Home Allowance September 2020 Tax Alert

Work From Home Jobs For Freshers Deloitte Operations Job Mnc Jobs Latest Jobs For Graduates Youtube

Working At Deloitte Us Ask A Question Comparably

Does Deloitte Provide A Welcome Kit And Wfh Set Up Allowance For 2021 New Joiners Deloitte New Joinees

Third Of Staff May Work From Home Permanently Post Covid Deloitte Report Business Standard News

Is Deloitte Usi Providing Welcome Kits To New Joiners Lateral Hires Coming In After March 2021 If Yes What Does It Include Also Are They Eligible For Any Work From Home Allowance

Deloitte Employee Benefits And Perks Glassdoor

We Are Deloitte Employee Benefits Deloitte Us

Give Tax Exemption To Work From Home Expenses Suggests Deloitte

Please Help With In Hand Salary Calculation Deloitte India Deloitte Fishbowl

Deloitte Tells Staff They Can Work From Home Forever R Big4

Deloitte Employee Benefits And Perks Glassdoor

Deloitte To Close Four Offices Accountancy Daily

Does Deloitte Offer Any Work From Home Benefits Or Stipends Deloitte Fishbowl